zelle shutting down two words that could send chills through your finances. Imagine waking up, trying to send a gift to a friend, and getting hit with “service unavailable.” If you’ve ever wondered, “Is Zelle going away… or just glitching out again?”—you’re in the right place.

The Real Scoop Behind “Is Zelle Going Away?”

You’ve probably seen headlines. Tech blogs speculating. Finance forums buzzing: “Zelle outage banking issues!” But here’s what you need right now: clarity.

Zelle remains active—but older versions, deprecated features, or integration changes can make people think it’s shutting down. Some banks may be phasing out the standalone Zelle app, recommending in-app banking access instead.

That shift is sparking confusion—and yes, even rumors that Zelle is discontinued. But here’s the nuance: the platform’s evolving, not evaporating.

What’s Behind the Confusion?

Zelle App Shutdown vs Service Continuity

If your bank says “Zelle app shutdown,” they typically mean they’re ditching the standalone app in favor of embedded banking integration. So long as you’ve got your bank’s app and your Zelle account, you’re good.

Outages That Fuel Panic

On days of zelle outage banking issues, services may slow or go offline entirely—especially during high traffic times like holidays. These sporadic interruptions get mistaken for service death—triggering rumors that Zelle is gone.

A Real-Life Pulse: Social Chatter

I came across someone writing (in casual tone):

“I tried sending my sister rent money yesterday—got nothing. ‘Zelle shutting down’ crossed my mind for real. Then I found out it was just maintenance. Stress for nothing.”

Sound familiar? That’s the human side of this puzzle—real frustration, amplified by unclear messaging.

Risks, Pros, and 2025 Usability (Expert Tone)

Pros of the Transition

- Improved security: Integrated apps benefit from your bank’s authentication systems.

- One-stop access: No need to juggle multiple apps—streamlined flow inside your trusted bank app.

- Better updates: Banks can push updates and alerts faster.

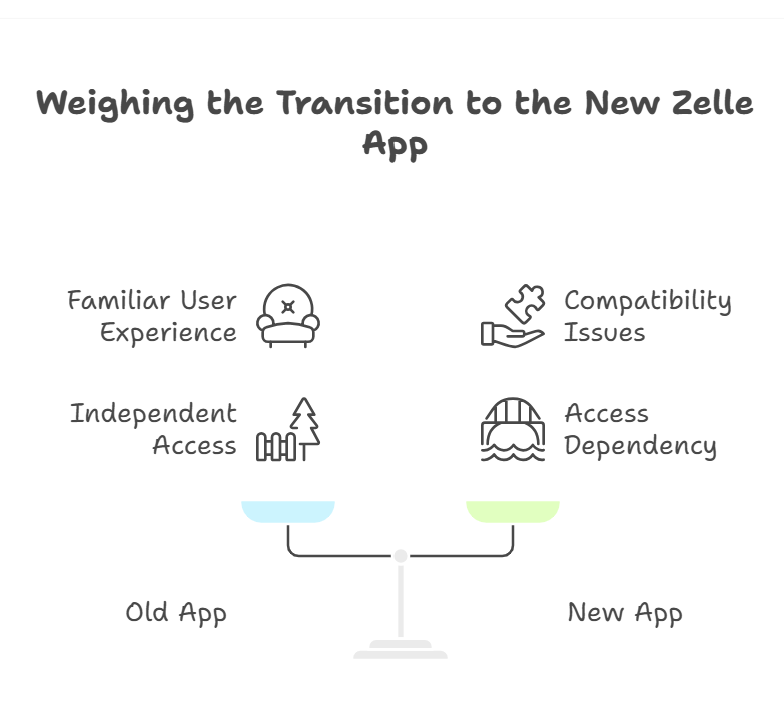

Cons to Watch Out For

- Confusion at first: People accustomed to the old app may feel blindsided.

- Compatibility issues: Older devices or OS versions might struggle with integrated features.

- Access dependency: If your bank’s app crashes, Zelle access disappears with it.

In 2025, financial usability means anticipating such shifts—and having backup plans ready.

Navigating the Shift Gracefully (Friendly Tips)

- Check your bank’s update notes—look for mention of “Zelle integration” or “Zelle app discontinued.”

- Update early—don’t wait for the alert: get the latest version and explore the Zelle section now.

- Save your bank’s support number—help is one tap away if something goes wrong.

- Have fallback options: Venmo, Cash App, or good old ACH transfers can be lifesavers when Zelle’s down.

FAQs

Q1: “Is Zelle shutting down or still available?”

No, Zelle isn’t shutting down entirely. But some banks are phasing out the standalone app in favor of embedding the service directly into their banking app. So it’s a change in access—not a full shutdown.

Q2: “Why did my bank say Zelle app is discontinued?”

Banks often discontinue the separate app to streamline security and user experience. They’re consolidating features into their main app—so you still get Zelle, just in a different place.

Q3: “What should I do during a Zelle outage banking issues?”

First—don’t panic. Check your bank’s status page, wait a few minutes, then try again. If it’s persistent, switch to ACH or another P2P app for urgent transfers.

Q4: “Will Zelle go away completely?”

While the standalone app may fade, the service is deeply embedded in many banks. Rebranding or technical shifts are possible, but it’s still a major part of digital payments today.

A Broader Perspective: Industry Trends

Consumer Behavior in 2025

People want fewer apps, not more. Financial consolidation—combined services under one roof—is the trend. Think: your bank app doing everything. That’s where the Zelle app shutdown news takes root—banks are building in direct access.

Security Trends

Post-pandemic fraud trends pushed banks to tighten access. Integrating Zelle into their apps makes it easier to safeguard with multi-factor authentication, biometrics, and real-time alerts.

Regulatory Landscape

Faster Payments legislation and consumer protection rules are encouraging banks to have clearer dispute processes. A consolidated app makes that compliance easier to track.

Pros and Cons Side-by-Side (Persuasive Tone)

| Pros | Cons |

|---|---|

| Stronger security through bank’s systems | Learning curve for users used to standalone Zelle app |

| Updates pushed directly through bank app | If bank app fails, Zelle access fails, too |

| Fewer apps = less clutter | Older devices may struggle with heavy integrated apps |

| Easier to monitor for fraud or suspicious activity | Some users may miss the simplicity of the standalone app |

Human Voices: A Real-Life Reaction

“I logged into my bank app, couldn’t find Zelle at first. Thought I lost money. Turned out it moved, and I just had to poke around. Smooth once I got the hang of it.”

That’s exactly how transitions go—confusion at first, then relief once you realize it’s all still there, just in a new home.

Final Thoughts

- Stay ahead: Don’t wait for the trembling moment when you need to send money.

- Update apps regularly—keep pace with the shift.

- Know your fallback options—so you’re never stuck.

- Embrace the integration—use the added security and oversight to your advantage.